سعر الذهب في السعودية اليوم الإثنين 13 يناير 2020 بالريال والدولار - صوت الدعاة - أفضل موقع عربي في خطبة الجمعة والأخبار المهمة

سعر غرام الذهب في السعودية| شامل كم سعر الذهب اليوم في السعودية بيع وشراء عيار 21 اليوم 8-8-2022 – ماركتنا

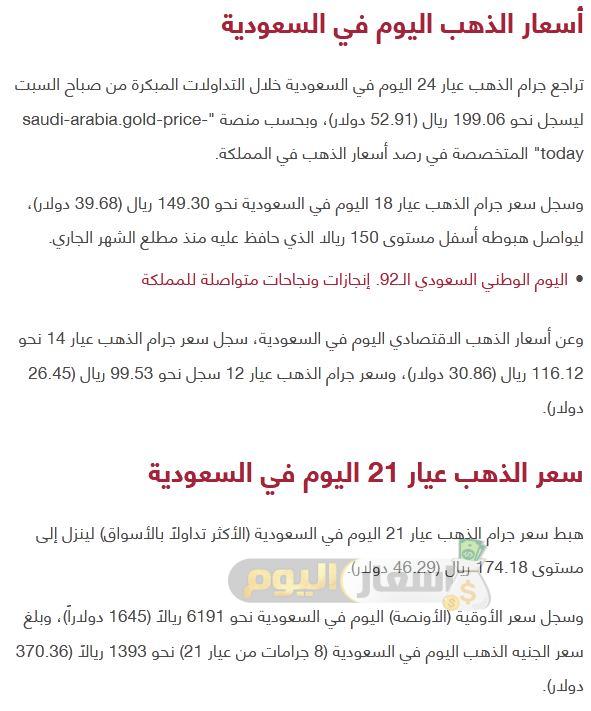

معيار القيمة.. اسعار الذهب اليوم في السعودية في المحلات لمختلف العيارات اليوم الأربعاء 20-7-2022 .. منوعات

سعر بيع وشراء الذهب اليوم في السعودية بالمصنعية| شامل قيمة الجرام بالسعر المباشر بسوق المال الخميس 21 نوفمبر – ماركتنا