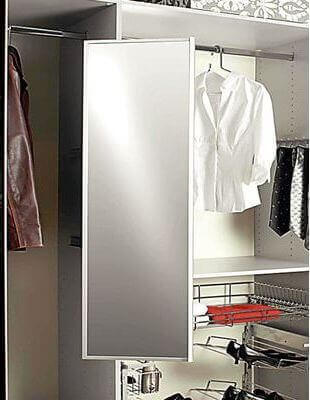

Armadi Firenze Specchi fissi e orientabili interni Art.75NS077 in Offerta Armadi su Misura Mobilificio Mugello Casa Dell'Armadio Firenze

Specchio estraibile per interiore di armadio Moka, 440, Verniciato moka, Tecnoplastica e Alluminio, 1 u.

Armadio multiuso a 1 anta con specchio, 100% Made in Italy, Mobile portascarpe, Scarpiera moderna, cm 72x37h195, colore Bianco | Leroy Merlin

Emuca Specchio estraibile per interni di armadio, Verniciato moka, Acciaio e Tecnoplastica e Vetro, 1 u.

Emuca Specchio estraibile per interni di armadio., Verniciato alluminio, Acciaio e Tecnoplastica e Vetro • Maniglie Design