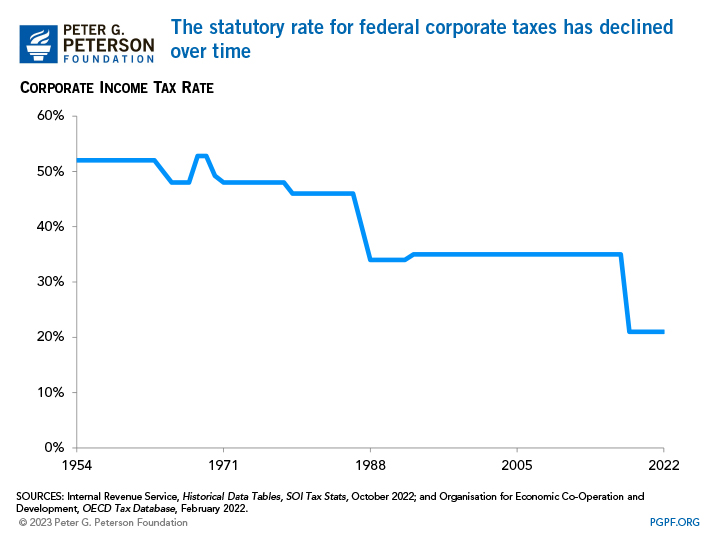

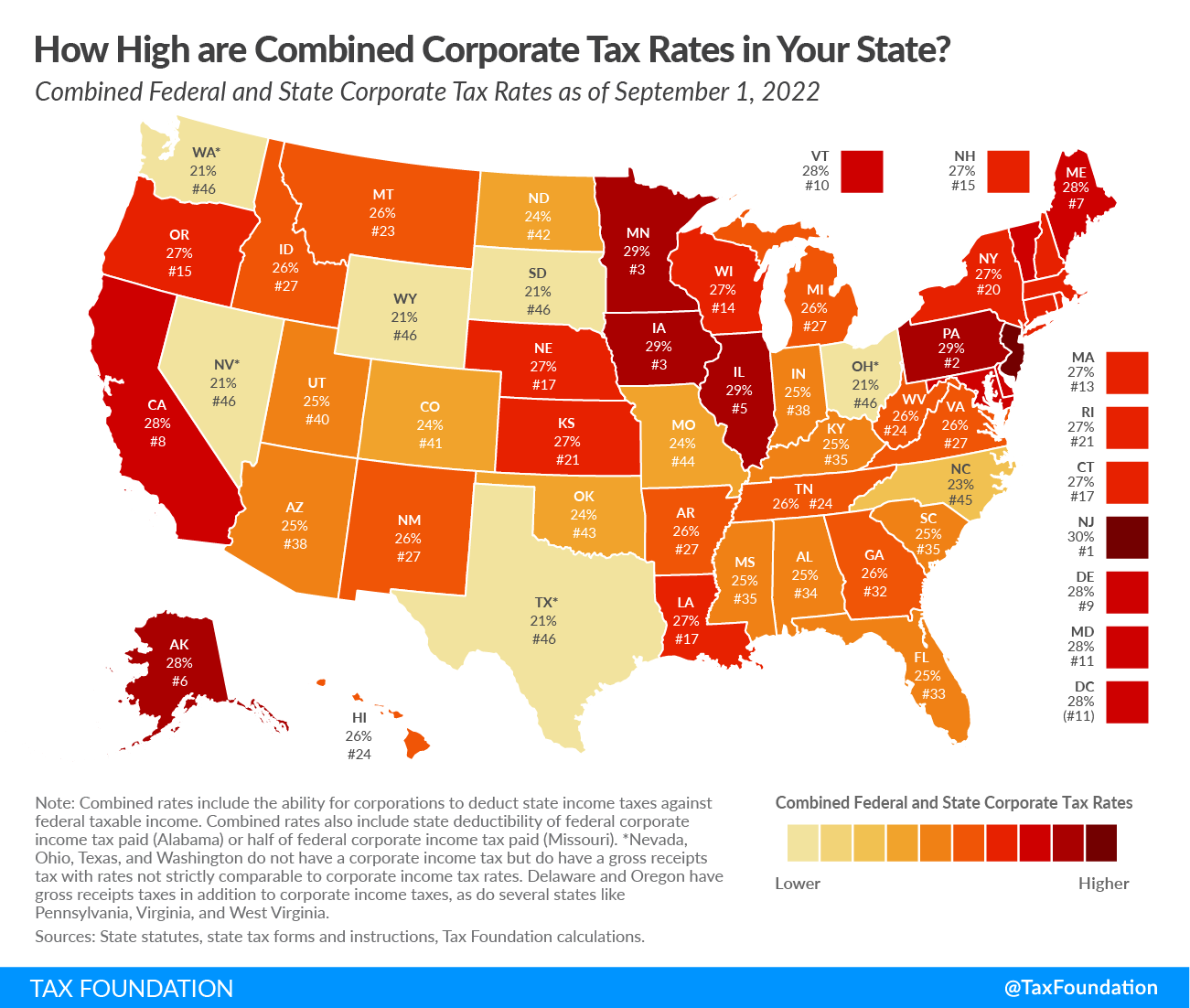

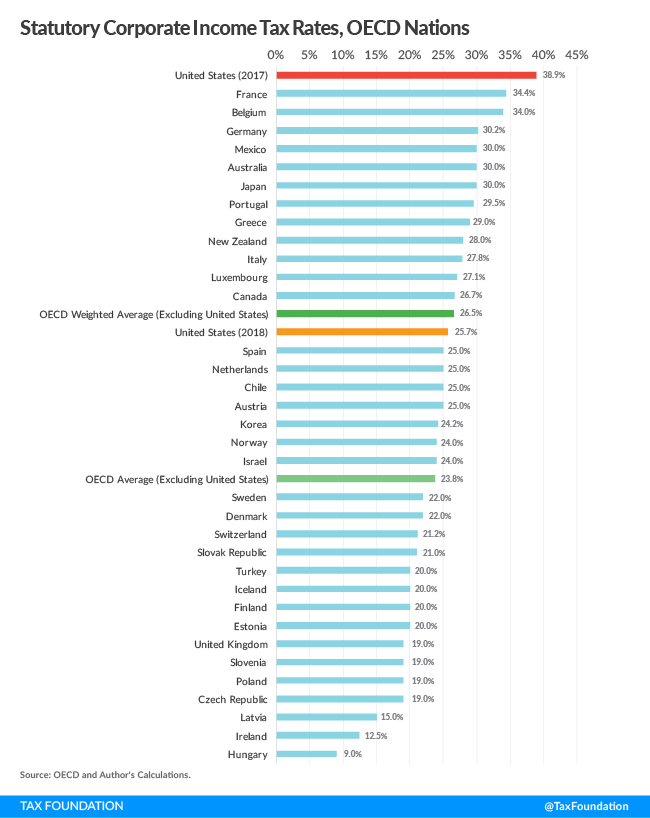

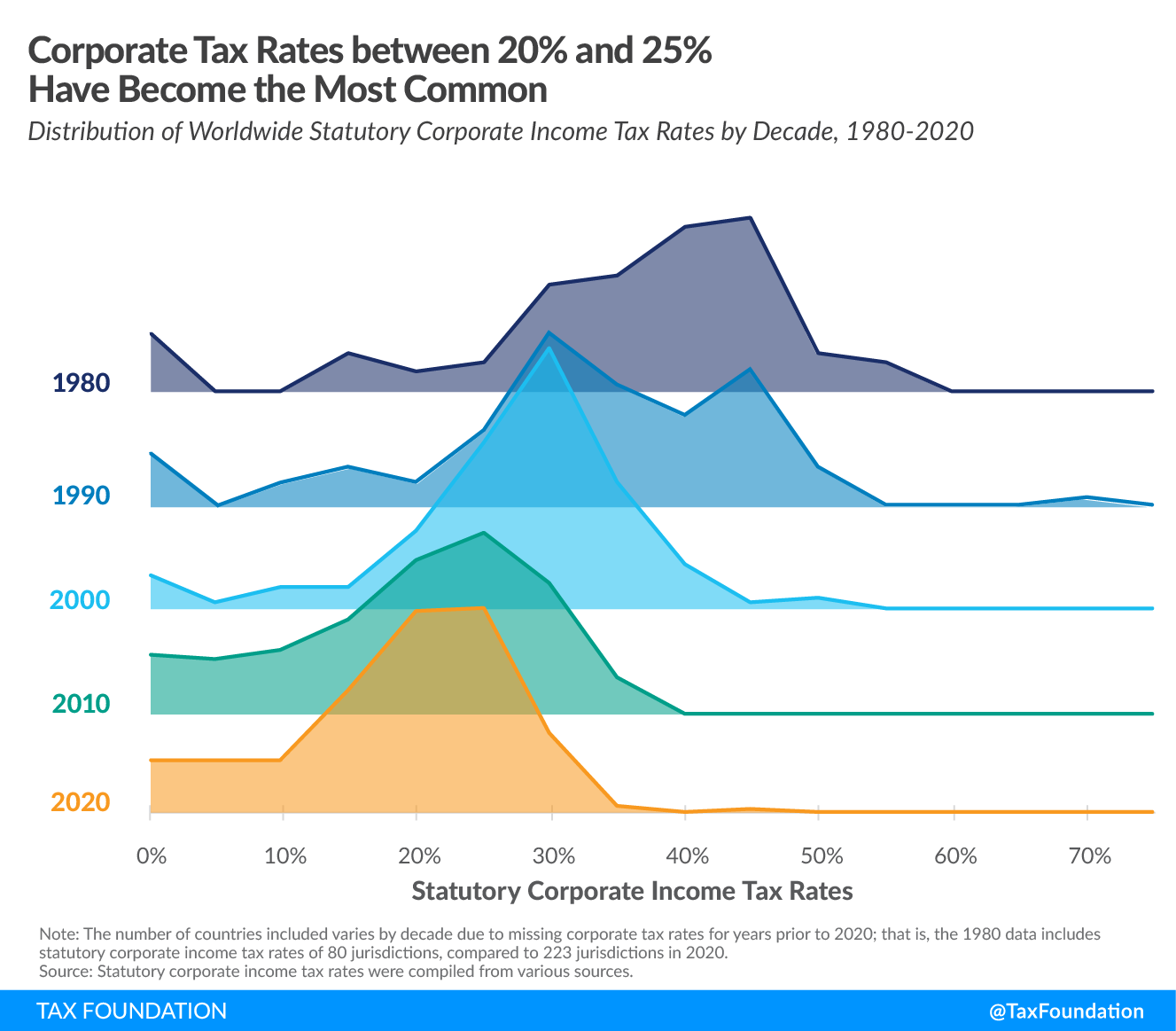

Tax Foundation on Twitter: "Prior to 2017 federal tax reform, the U.S. had the fourth highest corporate income tax rate in the world. It now ranks in the middle of the pack,

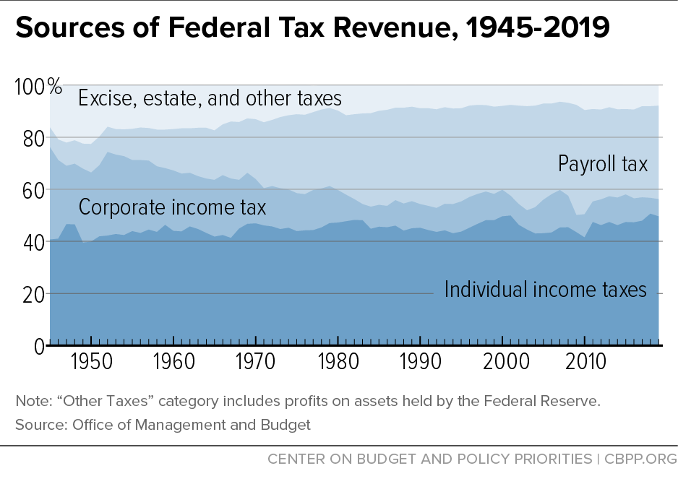

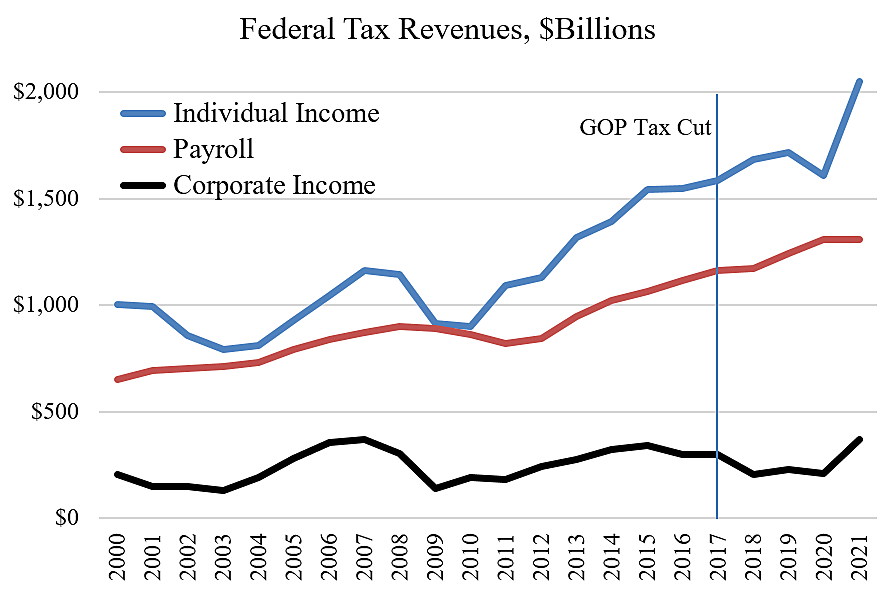

How do US corporate income tax rates and revenues compare with other countries'? | Tax Policy Center

:max_bytes(150000):strip_icc()/Term-Definitions_Income-tax-blue-9a708041207743b5a57cfdae08df2b10.jpg)