Where's My Refund - The IRS will begin processing Federal Tax returns starting January 28, 2019! If you are claiming Earned Income Credit or Additional Child Tax Credit your return will NOT

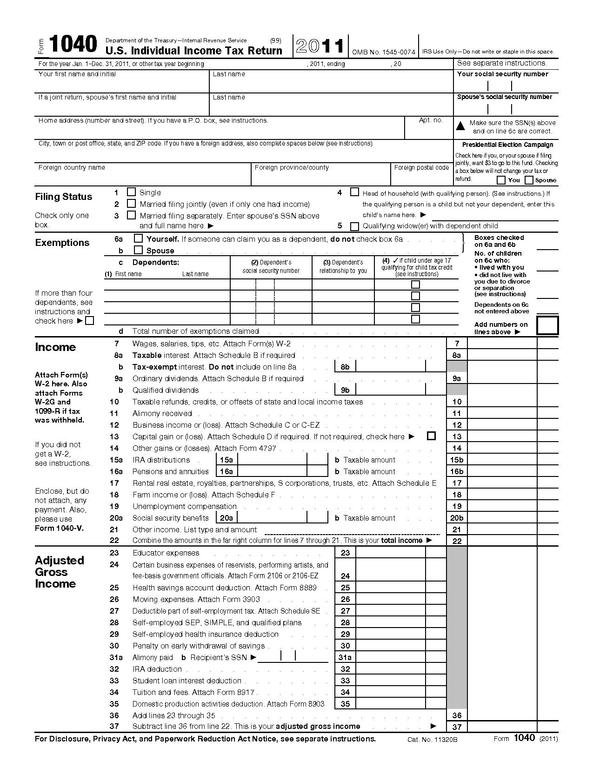

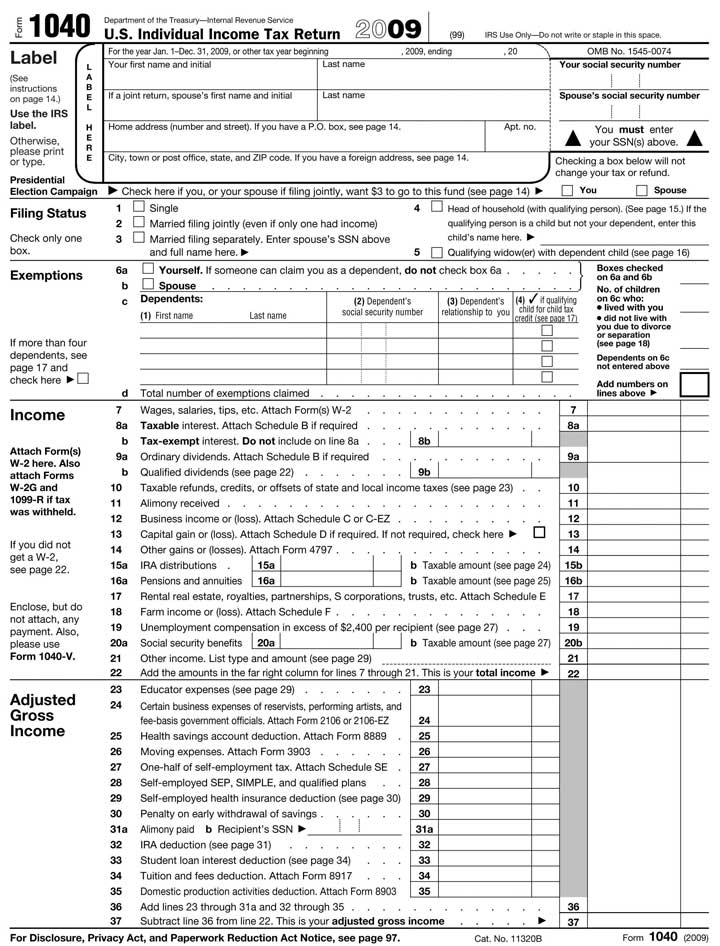

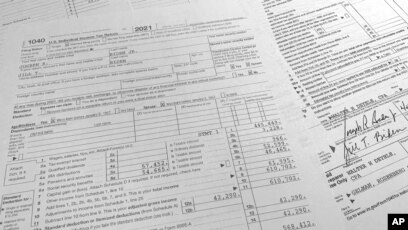

Obama's 2012 effective tax rate was 18.4 percent; Now what do your members of Congress pay in taxes? - Don't Mess With Taxes

/cloudfront-us-east-1.images.arcpublishing.com/gray/MNDBYVOWSJFE3MX45U2L2CUNNY.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)

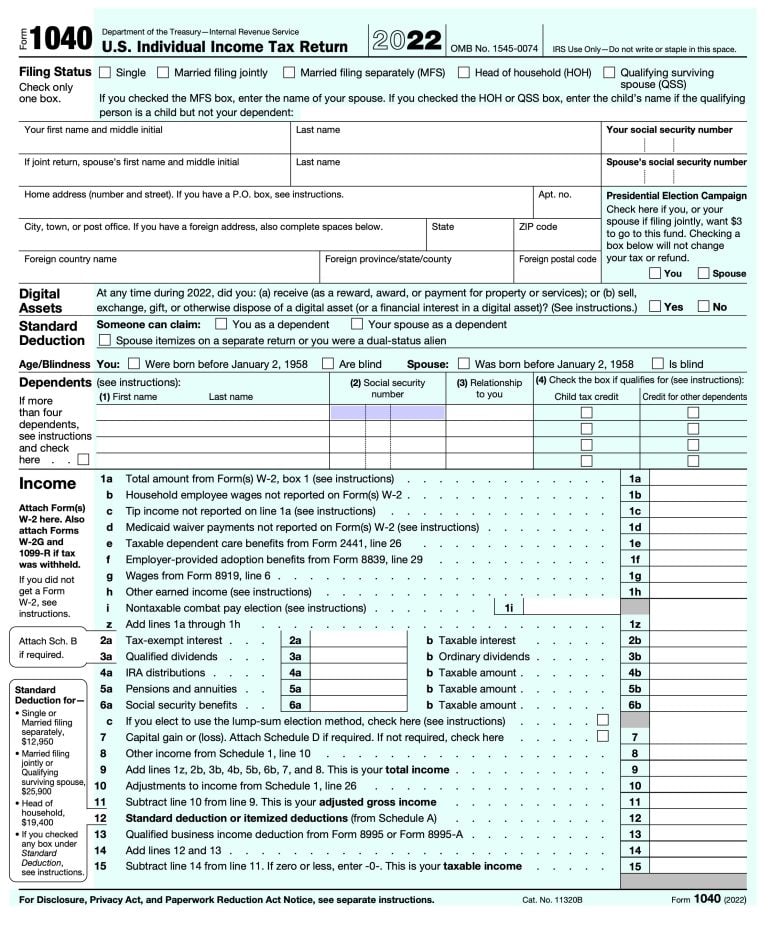

:max_bytes(150000):strip_icc()/Form1040-SR2022-b0b21772ee8a4be689090dccb27bfec0.jpg)