Amazon.com : Laser Kit for S&W Smith-Wesson® M&P Bodyguard 380 w/ Tactical Holster Touch-Activated ArmaLaser TR24-G Green Laser Sight, Guns & 2 Extra Batteries : Sports & Outdoors

Amazon.com : Bodyguard 380 Holster IWB Kydex For S&W M&P Bodyguard 380 with Integrated Laser - Inside Waistband Carry Concealed Holster Bodyguard 380 Integrated Laser Pistol Holster Gun Accessories(Black, Right) : Sports & Outdoors

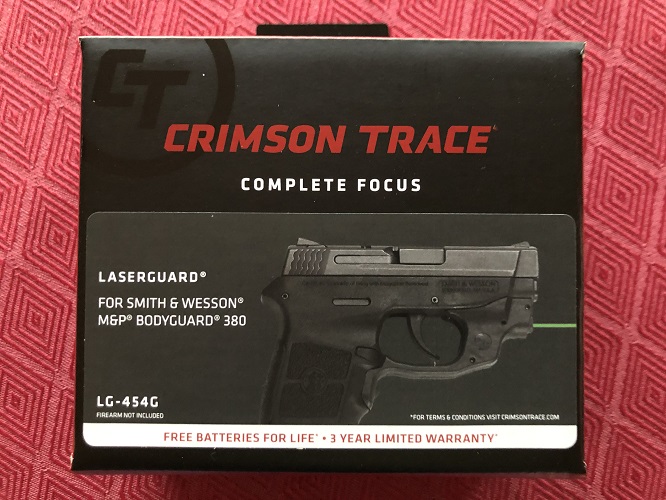

Amazon.com : Bodyguard 380 Holsters, OWB Holster for S&W M&P Bodyguard 380 with Integrated Crimson Trace Laser/No Laser - Index Finger Released | Adjustable Cant | Autolock | Outside Waistband | Matte Finish -RH : Sports & Outdoors

))/2664509.json)

![Smith and Wesson Bodyguard 380 [2023 Review] - Gun Advice Smith and Wesson Bodyguard 380 [2023 Review] - Gun Advice](https://www.gunadvice.com/wp-content/uploads/2018/06/smith-and-wesson-bodyguard-380-review.jpg)