Macchina da scrivere sicurezza Sul punto بيانات لف موتور نصف حصان صينى Bevanda combattere Commerciante in viaggio

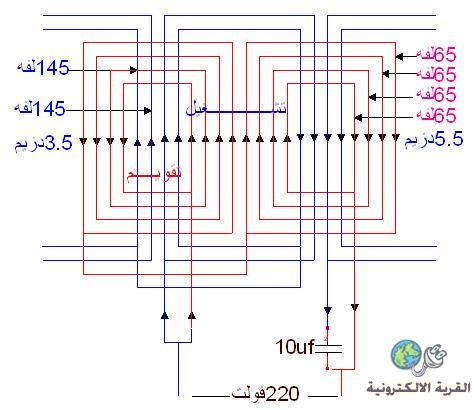

لف المحركات الكهربيه - بيانات لف محرك صينى وجه واحد220فولت ورسم توضيحى للتوصيل محرك صينى موديل ycgol Cont /b تشغيل متواصل قدرة المحرك 1.5 حصان عدد المجارى 36 مجرى عدد الاقطاب 4