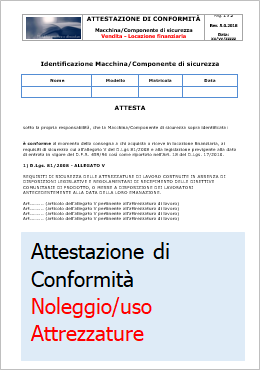

La manutenzione dei luoghi di lavoro e delle attrezzature di lavoro / SICUREZZA SCANAVINO / Studio Scanavino / Qualità, Sicurezza e Ambiente / Orbassano, Torino

Serie Di Icone Delle Linee Delle Attrezzature Di Sicurezza Illustrazione Vettoriale - Illustrazione di lineare, personale: 226284162

Protezione di sicurezza delle attrezzature di lavoro. Lavoratore in arancione vest azienda Casco giallo contro il sito in costruzione come sfondo Foto stock - Alamy